Working remotely has become a permanent reality for millions of Americans. If you’re one of the many professionals now using your home as your office, you might wonder if your current home insurance for remote workers provides adequate coverage. Most standard homeowners insurance policies only offer limited protection for work equipment, typically covering just $2,500 worth of business property.

This gap in coverage creates potential risks for remote workers who may have expensive equipment or receive clients at home. Your existing policy might not fully protect you against work-related accidents or liability claims that happen during business hours. Plus, some remote workers are surprised to learn that certain professional activities might actually violate their homeowners insurance terms.

The good news is that proper insurance protection is available for your home-based work situation. Whether you need enhanced coverage through your existing policy or a separate business policy depends on your specific situation. Understanding these options helps ensure you’re protected while enjoying the benefits of working from home.

Key Takeaways

- Standard homeowners insurance has limited coverage for business equipment, typically capping at $2,500 for work-related items.

- Remote workers may need additional coverage options like workers’ compensation depending on employment status and state requirements.

- Working from home can create new liability exposures that might not be covered under standard insurance policies.

Understanding Home Insurance for Remote Workers

Home insurance policies require special attention when you work remotely. Different arrangements affect your coverage needs and may require policy adjustments to protect both personal and business assets properly.

Defining Home Insurance and Remote Work

Home insurance typically covers your dwelling, personal property, liability, and additional living expenses if your home becomes uninhabitable. Remote work refers to performing job duties from home rather than a company office, whether on a fully remote, hybrid, or telecommuting basis.

When you work from home, the lines between personal and professional spaces blur. Standard home insurance policies are designed primarily for residential use, not business activities. This distinction matters because insurance coverage will differ based on whether you work for a company or are self-employed.

Many insurers limit business-related coverage to $2,500 or less for equipment, and liability coverage often excludes business-related incidents. Understanding these limitations is crucial for proper protection.

Unique Coverage Needs of Remote Workers

Remote workers face specific risks that traditional home insurance may not address adequately. Business equipment like computers, specialized software, and office furniture may exceed standard policy limits for business property.

Liability concerns also change when clients or colleagues visit your home for business purposes. If someone is injured during a work meeting at your home, your standard liability coverage might not apply because it was a business interaction.

Remote workers should also consider data breach protection, as handling sensitive company information from home creates cybersecurity vulnerabilities. Professional liability coverage becomes important if you provide advice or services that could result in claims of negligence.

Business interruption concerns are also relevant. If your home becomes unusable due to a covered peril, you need coverage that addresses both living arrangements and workspace needs.

Insurance Policy Types for Working from Home

Several insurance options exist for remote workers depending on their situation:

Homeowners Policy Endorsements:

- Business property endorsements (increases coverage for equipment)

- Home business endorsements (adds liability protection)

- Incidental business endorsement (for small-scale business activities)

Separate Business Policies:

- Business Owner’s Policy (BOP) – comprehensive coverage for small businesses

- Professional liability insurance – protects against claims of negligence

- Cyber liability insurance – covers data breach expenses

For company employees, employer insurance policies often protect company-owned equipment while in your home. However, work-from-home arrangements may expose companies to risks not covered by existing business insurance.

The right coverage combination depends on factors like work volume, client interactions, and equipment value. Consulting with an insurance professional helps ensure appropriate protection for your specific remote work arrangement.

Key Insurance Considerations and Benefits for Home-Based Work

Working remotely requires special insurance considerations that many people overlook. Standard home insurance policies often have limitations when it comes to business activities conducted in your home.

Liability and Lawsuits in Remote Work Arrangements

Remote workers face unique liability risks when conducting business from home. Standard homeowners’ insurance typically offers limited protection for work-related activities, with coverage often capped at $2,500.

Business visitors present a particular concern. If clients or colleagues visit your home office and suffer an injury, you could be held personally liable for damages.

Liability insurance provides crucial protection against potential lawsuits arising from these situations. This coverage helps pay for:

- Legal defense costs

- Medical expenses for injured parties

- Settlements or judgments

Remote workers should verify whether their employer’s liability coverage extends to their home workspace or if additional personal coverage is needed. Some insurers offer endorsements or riders to extend liability protection specifically for home-based work activities.

Protecting Business Equipment and Home-Based Businesses

Standard home insurance policies often have strict limits on business equipment coverage. These limits are frequently insufficient for remote workers with expensive computers, specialized equipment, or inventory.

Options to consider for better protection include:

Business Property Endorsement: Adds coverage to an existing homeowners policy

Business Owners Policy (BOP): Combines property and liability protection

Standalone Business Equipment Insurance: Covers specific high-value items

Home-based business owners need more comprehensive coverage than occasional remote workers. A dedicated home office coverage plan becomes essential when:

- Storing inventory at home

- Having frequent business visitors

- Operating specialized equipment

- Generating significant revenue from home

Regular inventory documentation and equipment value assessments help ensure adequate coverage levels as business assets grow or change.

Employers’ Responsibilities and Workers’ Compensation

Most states require employers to maintain workers’ compensation insurance for all employees, including those working remotely. This requirement applies to companies with as little as one employee in many jurisdictions.

Workers’ compensation benefits typically cover:

- Medical expenses for work-related injuries

- Partial wage replacement during recovery

- Rehabilitation costs

- Death benefits for dependents

Remote work arrangements can complicate claims, as employers must determine if injuries occurred during work hours and while performing job duties. Clear communication about when and where employees work helps establish coverage boundaries.

Employers should provide ergonomic guidelines and safety checklists to help prevent common home office injuries. Regular check-ins about workspace conditions demonstrate employer commitment to safety and may improve compliance with workplace standards.

Additional Coverage: Health, Auto, and Life Insurance

Remote workers should review their health insurance plans to ensure adequate coverage for the areas where they live and work. Telemedicine benefits have become increasingly important since COVID-19, allowing virtual access to healthcare providers.

Auto insurance requires special consideration for business-related driving. Regular commuting to an office versus occasional business errands affects policy needs differently. Activities to disclose include:

- Client meetings

- Supply pickups

- Mail/package deliveries

- Travel between work locations

Life insurance becomes especially important for independent contractors or self-employed remote workers who lack employer-provided benefits. Coverage should account for:

Income replacement needs: Supporting family members

Business continuation: Funding transitions if the business must close

Outstanding debts: Covering business loans or startup costs

Mental health support services, increasingly offered through insurance plans, provide valuable resources for remote workers dealing with isolation or work-life balance challenges.

Frequently Asked Questions

Remote workers face unique insurance challenges when protecting their home offices and work equipment. Understanding specific coverage options, costs, and claims processes can help ensure proper protection for both personal and professional assets.

What types of coverage should be considered for home offices under a home insurance policy?

Standard home insurance typically provides limited coverage for work equipment, usually between $1,500 and $2,500. This often falls short for remote workers with expensive computers, specialized equipment, or furniture.

Remote workers should consider adding endorsements to their homeowners insurance that specifically address business property. A home business endorsement can increase coverage limits for work equipment.

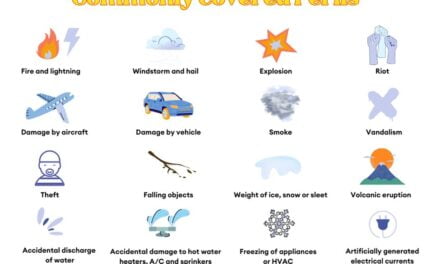

For more extensive protection, business personal property coverage can safeguard against damage from common perils like fire, theft, and water damage. Liability coverage is also essential if clients visit your home office.

Does home insurance cost differ for remote workers as compared to traditional office employees?

Home insurance premiums may increase slightly for remote workers due to the additional coverage needed for business equipment. The increase typically ranges from $25 to $100 annually depending on coverage limits.

Insurance companies consider the increased risk of having expensive equipment at home and potential liability issues. Some insurers offer special work-from-home insurance packages with bundled discounts.

Factors affecting premium adjustments include the value of work equipment, frequency of client visits, and the nature of your remote work activities.

How does a home insurance claim process work in case of equipment damage for a remote employee?

When work equipment is damaged, first determine whether it’s covered under your employer’s insurance or your personal policy. Many employers provide coverage for company-owned equipment regardless of location.

Document the damage with photos and gather proof of ownership such as receipts or company asset tags. Contact your insurance provider promptly to report the claim.

Be prepared to demonstrate the equipment was damaged by a covered peril (like fire or water damage). Claims for business equipment may require additional documentation compared to personal property claims.

Are there any special endorsements needed on a standard home insurance policy to cover a home-based business?

Standard home insurance policies typically exclude or severely limit coverage for business activities, making endorsements necessary for adequate protection. A home business endorsement can extend coverage for business property and limited liability.

For more comprehensive protection, consider an in-home business policy or a business owner’s policy (BOP). These provide higher coverage limits and additional protections like business interruption coverage.

Remote workers who maintain inventory or have specialized equipment may need commercial property insurance to ensure full replacement coverage.

What is the impact of frequent business-related visitors on my residential insurance coverage?

Having clients or colleagues regularly visit your home for business purposes significantly increases liability risk, which standard home insurance doesn’t adequately cover. Business liability insurance becomes essential in these situations.

Your home insurance may even exclude coverage for injuries to business visitors entirely. This creates a serious gap in protection that requires additional coverage.

Notify your insurance provider about regular business visitors to ensure appropriate coverage and avoid claim denials based on undisclosed business activities.

How can remote workers ensure adequate coverage for work-related assets in their home insurance policy?

Create a detailed inventory of all work equipment with photos, descriptions, and estimated values. This documentation is crucial for both determining necessary coverage levels and supporting future claims.

Review your policy’s specific sublimits for business property and understand what perils are covered. Many remote workers need additional coverage beyond standard policy limits.

Consider a scheduled personal property endorsement for high-value items like specialized computer equipment or photography gear. This provides coverage for the full replacement cost regardless of standard policy limits.