Owning a home is becoming more challenging as natural disasters increase in frequency and severity. Many homeowners are discovering that their insurance options are changing due to climate change effects. Rising premiums and fewer coverage choices are creating a growing crisis for property owners across the country.

Homeowners need to understand their insurance options as climate change continues to intensify extreme weather events that put properties at risk. The insurance market is responding to these changes in various ways, including developing new risk transfer innovations to improve resilience against climate challenges. Some regions are seeing insurers withdraw from high-risk areas entirely, leaving homeowners to seek alternative coverage solutions.

As these changes unfold, it’s essential to stay informed about the climate change-fueled property insurance crisis and explore home insurance options for natural disasters. Understanding available options now can help homeowners prepare financially for the changing insurance landscape.

Key Takeaways

- Climate change is transforming the home insurance market with higher premiums and reduced coverage availability in high-risk areas.

- Homeowners should explore alternative insurance products and risk-reducing home improvements to maintain adequate protection.

- Government programs and private sector innovations are emerging to address insurance gaps caused by increasing natural disaster risks.

The Impact of Climate Change on Home Insurance

Climate change is directly affecting how homeowners insurance works across America. Extreme weather events have forced insurance companies to adjust their policies, prices, and availability in response to growing risks.

Increasing Frequency of Natural Disasters

Natural disasters linked to climate change are happening more often and causing more damage. In recent years, the U.S. has experienced record-breaking wildfires in California, devastating hurricanes along the Gulf Coast, and destructive flooding in many regions.

Insurance companies have paid out billions for weather-related risks, with costs continuing to climb. Between 2018 and 2022, insurers faced significantly higher costs in areas with the greatest expected climate risks.

The insurance industry now uses advanced modeling to predict future climate-related risks. These models show troubling trends – what were once “100-year floods” or “once-in-a-generation” wildfires are becoming regular occurrences.

This shift in severe weather events has fundamentally changed how insurers calculate and price risk.

Rising Insurance Premiums and Affordability Concerns

Home insurance premiums have increased dramatically as companies adjust to the changing climate. Insurance rates jumped 33.8% between 2018 and 2023, largely due to escalating weather-related risks.

These rising costs create serious affordability concerns for many homeowners. Some families, especially those in moderate to low-income brackets, struggle to maintain adequate coverage.

Several factors drive these increases:

- Growing expense of rebuilding after disasters

- Higher cost of reinsurance (insurance for insurance companies)

- More frequent extreme weather events

- Inflation affecting construction materials

In high-risk areas, some homeowners now pay annual premiums that exceed $10,000 – making insurance nearly as expensive as mortgage payments in certain cases.

Insurer Responses and Changes in the Insurance Market

Insurance companies are responding to climate risks in several significant ways. Many insurers have:

- Restricted coverage in high-risk areas

- Increased deductibles specifically for weather-related claims

- Created specialized policies with different terms for climate perils

- Invested in their own climate research to better understand future risks

Some major insurance companies have completely withdrawn from markets with the highest climate risks. This has created “insurance deserts” where homeowners struggle to find any coverage.

The Treasury Department reports that climate change is making it more costly for insurers to operate effectively. This has led to market concentration, with fewer companies willing to offer policies in certain regions.

Property Values and High-Risk States

Climate risks are increasingly affecting property values across the country. Homes in areas prone to wildfires, flooding, or hurricanes have seen market values impacted in two ways:

First, properties with higher insurance costs become less attractive to buyers. When insurance premiums increase dramatically, the total cost of homeownership rises, potentially lowering what buyers will pay.

Second, homes in areas where insurance is difficult to obtain face significant value challenges. Without insurance, mortgages become impossible to secure, dramatically shrinking the pool of potential buyers.

High-risk states like California, Florida, Louisiana, and Colorado have experienced the most dramatic insurance market changes. In these regions, state governments have had to create special insurance programs to fill gaps left by retreating private insurers.

Insurance Options and Strategies for Homeowners

As climate change drives more frequent and severe natural disasters, homeowners face new challenges in protecting their properties. Insurance markets are evolving rapidly in response to these risks, creating both challenges and opportunities for coverage.

Types of Insurance Coverage for Climate Risks

Standard homeowners insurance typically covers wind damage and fire, but often excludes flooding and sometimes earthquake damage. For flood protection, the National Flood Insurance Program (NFIP) provides coverage in participating communities, though private flood insurance options are growing more available.

Many homeowners are surprised to learn about coverage gaps when filing claims. For example:

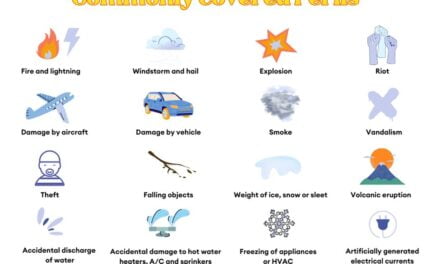

- Covered in standard policies: Fire, wind, hail, lightning

- Usually excluded: Flood, earthquake, earth movement

- Sometimes limited: Mold damage, hurricane deductibles

Parametric insurance is an emerging option that offers quicker payouts based on event triggers rather than assessed damage. This can provide faster funds after disasters when traditional claims might take months to process.

Homeowners should carefully review policy details, especially exclusions and deductibles that apply specifically to climate-related events.

Navigating Premium Increases and Affordability Solutions

Insurance premiums are rising dramatically in high-risk areas, with some homeowners seeing annual increases of 20% or more. When facing steep premium hikes, homeowners have several options:

- Increase deductibles to lower monthly payments

- Bundle policies (home, auto, life) for multi-policy discounts

- Improve home resilience to qualify for mitigation discounts

- Shop multiple carriers annually to compare rates

In states with affordability challenges, Fair Access to Insurance Requirements (FAIR) Plans provide last-resort coverage for properties that cannot obtain insurance on the private market. These plans typically offer basic coverage at higher-than-market rates.

Many insurers now offer pay-as-you-go options and flexible payment schedules to help manage costs without sacrificing necessary protection.

Risk Prevention Measures and Building Codes

Implementing risk prevention measures can both protect homes and reduce insurance costs. Many insurers offer premium discounts for:

- Hurricane straps and reinforced roofing (10-15% discount)

- Elevated electrical systems in flood-prone areas

- Fire-resistant landscaping and building materials

- Home security systems and water leak detection devices

Hazard-resistant building codes are becoming more stringent in vulnerable regions. New construction often incorporates climate resilience features like impact-resistant windows and elevated foundations.

Before renovating or building, homeowners should consult local building officials about current codes designed for regional hazards. Exceeding minimum requirements can pay off through lower insurance costs and better protection.

Insurance companies increasingly use sophisticated risk assessment tools to evaluate individual properties, making home-specific mitigation measures more valuable than ever.

Government Programs and Alternative Insurance Solutions

When private insurance becomes unavailable or unaffordable, government programs provide critical safety nets. The National Flood Insurance Program remains the primary flood insurance provider, though it faces ongoing financial challenges.

Some states have established:

- Catastrophe funds that help insurers manage extreme losses

- Beach and windstorm plans for coastal properties

- Mitigation grant programs to help homeowners upgrade properties

New market solutions are emerging to fill coverage gaps. These include:

Community-based insurance pools risk among local property owners, potentially lowering costs through shared mitigation efforts.

Microinsurance products offer limited but affordable coverage for specific perils, helping homeowners protect against their most concerning risks without paying for comprehensive policies.

State insurance departments can guide homeowners to available options when traditional coverage disappears from local markets.

Frequently Asked Questions

Climate change is altering the insurance landscape for homeowners across the country. Rising natural disaster frequencies and intensities have prompted significant adjustments in coverage options, assessment methods, and pricing strategies from insurance providers.

How do insurers assess the risk of natural disasters related to climate change for home insurance policies?

Insurance companies use sophisticated risk modeling that incorporates historical data, weather patterns, and climate projections to evaluate property risks. These models analyze factors like elevation, proximity to wildfire zones, flood plains, and coastal areas.

Climate change has forced insurers to continually update their assessment tools. Many companies now use advanced predictive analytics to anticipate future disaster probabilities rather than relying solely on historical events.

Property-specific features also factor into assessments. Roof age, building materials, and foundation type all influence how a home might withstand extreme weather events like hurricanes or flooding.

What types of coverage should homeowners consider to protect against damages from climate change-induced events?

Standard homeowners policies typically cover fire and wind damage but have significant limitations for other climate-related perils. Flood insurance is almost always a separate policy, usually through the National Flood Insurance Program.

Wildfire coverage varies by region and insurer. Homeowners in high-risk wildfire zones should verify their policy includes adequate protection without excessive deductibles.

Extended replacement cost coverage helps protect against post-disaster construction cost spikes. This option provides additional funds beyond standard limits when rebuilding costs surge after widespread damage.

Business interruption or additional living expenses coverage becomes crucial when climate disasters make homes temporarily uninhabitable. This helps cover hotel stays, rentals, and other displacement costs.

Are there any sustainable or environmentally friendly home insurance options that provide coverage for climate-related risks?

Green rebuilding coverage allows homeowners to rebuild with sustainable materials and energy-efficient systems after a covered loss. This option typically costs more but supports environmentally responsible reconstruction.

Some insurers offer discounts for homes with green certifications or features. Solar panels, efficient HVAC systems, and sustainable building materials can qualify for premium reductions with certain providers.

Parametric insurance represents an innovative approach gaining popularity. Rather than covering specific damages, these policies pay predetermined amounts when certain measurable conditions (like wind speed or rainfall) occur.

How can homeowners lower their insurance premiums while still ensuring adequate coverage for potential climate change impacts?

Home hardening measures can significantly reduce premiums. Installing impact-resistant roofing, storm shutters, and reinforced doors demonstrates risk reduction to insurers and may qualify for discounts.

Higher deductibles typically lower premium costs. Homeowners should consider their financial ability to absorb more out-of-pocket expenses against the monthly savings on premiums.

Bundling multiple policies with one insurer often results in substantial discounts. Combining home, auto, and other coverage can reduce overall insurance costs while maintaining necessary protection.

Regular insurance reviews ensure homeowners aren’t paying for unnecessary coverage. As property values and replacement costs change, policy limits should be adjusted accordingly.

In what ways might climate change affect the availability and affordability of home insurance in high-risk areas?

Insurance companies are raising rates, increasing deductibles, and excluding certain perils in climate-vulnerable regions. These changes reflect the growing financial risks insurers face from more frequent and severe weather events.

Some insurers have completely withdrawn from high-risk markets. California, Florida, and coastal Texas have experienced significant reductions in available insurance options as companies limit their exposure.

State-backed insurance programs often become the insurers of last resort. These programs provide coverage when private options disappear but typically at higher costs with more limited protection.

Risk-based pricing is becoming more granular. Properties with similar values may see drastically different premiums based on specific location factors like elevation, drainage, and proximity to fire-prone vegetation.

What proactive measures can homeowners take to make their properties more resilient to climate change effects and how does this relate to insurance?

Elevating homes in flood-prone areas reduces risk and may lower insurance costs. Even raising a structure a few feet above base flood elevation can significantly impact premium calculations.

Fire-resistant landscaping creates defensible space around homes in wildfire zones. Removing flammable vegetation near structures and using fire-resistant plants can improve insurability.

Upgrading to impact-resistant windows, doors, and roofing materials helps homes withstand severe storms. These improvements often qualify for insurance discounts while providing better protection.

Documentation of home improvements and regular maintenance creates a stronger case for insurance coverage. Keeping detailed records of resilience measures helps when negotiating with insurers or filing claims.