Finding the best home insurance quotes can be overwhelming, but getting multiple quotes is the first step toward securing the best coverage at a fair price. The best way to shop for homeowners insurance is to compare quotes through an insurance marketplace or an independent agent who can help you evaluate different options. When you compare quotes from multiple insurers, you gain a clearer picture of the market and increase your chances of finding better coverage at competitive rates.

When seeking home insurance quotes, don’t just focus on the premium amount. Pay close attention to coverage details, exclusions, and deductibles. Many homeowners make the mistake of choosing the cheapest option without understanding what’s actually covered. You can get homeowners insurance quotes online, by phone, or through an agent depending on how much guidance you need during the process.

Key Takeaways

- Comparing quotes from multiple insurance companies is essential for finding the best homeowners insurance policy at competitive rates.

- When evaluating home insurance quotes, coverage details and exclusions are more important than simply choosing the lowest premium.

- Using insurance marketplaces or independent agents can streamline the quote comparison process and help identify the right coverage for your specific needs.

Understanding Home Insurance Basics

Home insurance protects your property and belongings from damage or theft. It also offers liability coverage if someone gets injured on your property.

Types of Homeowners Insurance

Home insurance comes in several forms, each providing different levels of protection. The most common policy is an HO-3, which covers your home against all perils except those specifically excluded in the policy.

HO-1 and HO-2 policies are more limited, covering only named perils. For luxury homes, an HO-8 policy offers specialized coverage.

Condo owners typically need an HO-6 policy, while renters should get HO-4 coverage to protect their belongings.

Each policy type has different coverage limits and exclusions. Most standard homeowners insurance policies don’t cover floods or earthquakes, which require separate policies.

The type you choose should match your property type, location risks, and budget constraints.

Key Components of a Home Insurance Policy

A typical home insurance policy consists of several critical parts. Dwelling coverage protects the physical structure of your home and attached structures like garages.

Personal property coverage insures your belongings against damage or theft. Most policies offer between 50-70% of your dwelling coverage for personal items.

Liability insurance protects you if someone is injured on your property or if you accidentally damage someone else’s property.

Other components include:

- Additional living expenses coverage

- Medical payments coverage

- Other structures protection

The declarations page lists your coverage amounts, deductibles, and premium costs. This page is essential for understanding what’s covered and what’s not.

Importance of Coverage Limits

Coverage limits determine the maximum amount your insurer will pay for a covered loss. Setting appropriate limits is crucial to avoid being underinsured.

Your dwelling coverage amount should match your home’s replacement cost—not its market value or purchase price. This ensures you can rebuild your home completely if it’s destroyed.

For personal property coverage, take inventory of your belongings to determine adequate coverage. High-value items like jewelry or art may need additional riders.

Replacement cost coverage pays to replace items at today’s prices, while actual cash value coverage factors in depreciation. The former costs more but provides better protection.

Many experts recommend liability coverage of at least $300,000, though those with significant assets should consider higher limits or an umbrella policy for extra protection.

How to Assess Your Insurance Needs

Before shopping for home insurance quotes, you need to understand exactly what you’re protecting and how much coverage you need. Taking inventory of your property and considering potential risks will help you avoid being underinsured or paying for unnecessary coverage.

Evaluating Your Property and Belongings

Start by creating a detailed home inventory of your possessions. Document valuable items with photos and keep receipts for major purchases. This inventory will be crucial if you ever need to file a claim.

Consider using a home inventory app or spreadsheet to track:

- Electronics and appliances

- Furniture and fixtures

- Clothing and personal items

- Jewelry and collectibles

- Tools and outdoor equipment

Don’t forget items stored in attics, basements, or garages. For high-value possessions like jewelry or art, you might need additional coverage beyond standard policy limits. Customizing your coverage helps ensure these items are properly protected.

Calculate the current replacement cost of your belongings rather than their depreciated value. This provides more comprehensive protection if items need to be replaced.

Determining Adequate Coverage for Your Home

The structure of your home requires careful consideration when selecting coverage amounts. Base your dwelling coverage on the rebuild cost—not the market value or purchase price.

Factors affecting your home’s rebuild cost include:

- Square footage and number of rooms

- Construction materials and special features

- Local building costs

- Age and condition of the home

- Built-in appliances and fixtures

Consider consulting a local builder or using online calculators to estimate current rebuild costs in your area. Remember that construction costs often increase over time, so reviewing this number annually is important.

A good policy should include sufficient coverage for additional living expenses if you’re displaced from your home during repairs. This covers hotel stays, restaurant meals, and other costs while your home is uninhabitable.

Considering Special Coverage Options

Standard home insurance policies have limitations. Depending on your location and circumstances, you may need additional protection against specific risks.

If you live in a flood-prone area, standard policies won’t cover water damage from flooding. Separate flood insurance is essential. Similarly, earthquake and windstorm coverage typically require separate policies or endorsements in high-risk regions.

An umbrella policy provides extra personal liability coverage beyond your homeowners insurance limits. This affordable addition protects your assets if someone is injured on your property and sues for an amount exceeding your standard coverage.

Other specialized coverage options to consider include:

- Home business coverage

- Identity theft protection

- Water backup coverage

- Equipment breakdown protection

Review these options based on your specific situation rather than automatically adding everything available.

Securing Best Home Insurance Quotes and Policies

Finding the right home insurance means understanding how to compare quotes, recognizing policy limitations, and balancing cost with coverage. The process requires attention to detail and knowledge of insurance terminology.

Getting and Comparing Quotes

The first step in finding home insurance is to get multiple quotes from different insurance companies. This helps you compare prices and coverage options.

Use online tools like comparison websites to quickly gather several quotes. Many insurers offer online quote systems, but you can also call companies directly or work with an independent insurance broker.

When comparing quotes, don’t focus solely on price. Look at:

- Coverage limits for dwelling, personal property, and liability

- Optional coverages included

- Company reputation and financial stability

- Customer service ratings

Remember to provide the same information to each company to ensure you’re comparing equivalent policies. This includes details about your home’s age, construction, security features, and claims history.

Analyzing Policy Exclusions and Endorsements

Home insurance policies contain exclusions—things they won’t cover. Understanding these exclusions is crucial when comparing policies.

Common exclusions include:

| Typically Excluded | May Require Additional Coverage |

|---|---|

| Flood damage | Flood insurance |

| Earthquake damage | Earthquake endorsement |

| Mold | Mold remediation coverage |

| Normal wear and tear | Home warranty |

Read the fine print carefully. Some policies exclude roof damage beyond a certain age or limit coverage for jewelry, electronics, or art.

If you need coverage for excluded items, consider endorsements (add-ons) to your policy. These provide additional protection for specific risks or valuable items not fully covered by standard policies.

Understanding Insurance Costs and Deductibles

Your insurance premium is affected by several factors. The home’s location, construction type, age, and claims history all influence costs.

Deductibles play a significant role in both premiums and out-of-pocket expenses. A deductible is what you pay before insurance coverage kicks in. Higher deductibles generally mean lower premiums.

Most policies offer two types of deductibles:

- Standard deductible: Applied to most claims

- Percentage deductible: For specific perils like hurricanes or windstorms

Insurance companies offer various discounts that can reduce your premium:

- Multi-policy (bundling with auto insurance)

- Security system installation

- Impact-resistant roofing

- Smoke-free home

- Senior citizen discounts

Review your policy annually to ensure your coverage still meets your needs and to check for new discount opportunities.

Finalizing Your Home Insurance Purchase

After comparing quotes and understanding coverage options, it’s time to make your final decision and secure your policy. This crucial step requires careful consideration of both your insurance provider and how to prepare for potential claims.

Selecting Your Insurance Provider

When choosing an insurance company, look beyond just the price. Check the insurer’s financial stability and claims history to ensure they’ll be able to pay out if you file a claim.

Consider these factors when making your final selection:

- Customer service reputation: Look for companies with responsive representatives and 24/7 claim filing options.

- Claims processing efficiency: Research how quickly they typically handle claims.

- Discounts available: Many insurers offer reduced rates for home security systems, sprinkler systems, or bundled policies.

Most mortgage lenders require proof of insurance before closing. They may set up an escrow account to pay your homeowners insurance cost along with your mortgage payment.

Before signing, read the policy details carefully. Ask an insurance expert to explain anything unclear about coverage limits or exclusions.

Preparing for the Unexpected

Once you’ve purchased your policy, take proactive steps to prepare for potential claims. Create a home inventory with photos and receipts of valuable possessions to streamline future claims.

Consider these preparedness strategies:

- Build an emergency fund to cover your deductible if you need to file a claim

- Install safety devices like smoke detectors and security systems for both protection and possible premium discounts

- Review your policy annually to ensure coverage still meets your needs as your home value changes

Keep digital copies of your policy documents in multiple locations. Store the insurance company’s contact information where you can easily access it during emergencies.

Stay within your budget by choosing appropriate deductibles. Higher deductibles lower premiums but require more out-of-pocket payment when filing claims. Carefully balance this tradeoff based on your financial situation.

Frequently Asked Questions

Homeowners often have specific questions when shopping for insurance policies across different locations and providers. These common questions address crucial factors that impact both coverage quality and pricing.

What factors should I consider when comparing home insurance rates across different ZIP codes?

Insurance rates vary widely by location due to different risk factors. ZIP codes with higher crime rates or frequent natural disasters like floods or wildfires typically have higher premiums.

Construction costs in your area also affect replacement value calculations. Local building codes and materials availability can significantly impact what you’ll pay.

Historical claim data for your neighborhood influences pricing too. Areas with frequent claims history will generally face higher rates regardless of your personal claims record.

How can I ensure that I’m using the best home insurance comparison sites effectively?

Enter identical information across all comparison platforms to get truly comparable quotes. Even small differences in the details you provide can lead to significant price variations.

Look for sites that partner with a wide range of insurers, not just a select few. The most effective comparison tools include both national carriers and regional insurers.

Verify that the comparison site is updating rates regularly. Insurance pricing changes frequently, and outdated information won’t help you make informed decisions.

What are the key indicators of a reliable and comprehensive homeowners insurance policy?

Clear coverage limits for dwelling, personal property, liability, and additional living expenses are essential. These should align with your specific needs rather than just meeting minimum requirements.

Look for policies that offer guaranteed replacement cost rather than actual cash value. This ensures you can rebuild without depreciation deductions.

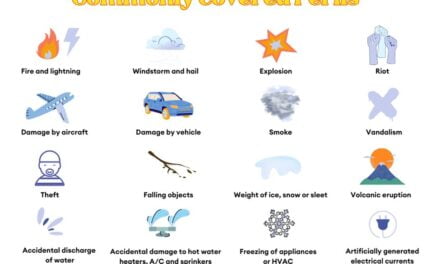

Check the list of covered perils carefully. The best policies cover a wide range of events including fire, theft, wind damage, and water damage from plumbing failures.

How many homeowners insurance quotes are typically necessary to find the best coverage?

Most insurance experts recommend gathering at least three to five quotes for adequate comparison. This provides sufficient data to identify pricing patterns and coverage differences.

Shopping around becomes even more important in unique situations, such as owning an older home or having special valuables. In these cases, expanding your search to 5-7 quotes might reveal specialized providers.

Remember that the cheapest quote isn’t always the best value. Comparing details between 3-5 carefully selected providers usually strikes the right balance between thoroughness and efficiency.

How does the location of a property, such as in Texas, affect the choice of the best home insurance?

Regional risks heavily influence what constitutes optimal coverage in different locations. Texas homeowners typically need to consider hurricane and tornado coverage more than those in other regions.

Some states have unique insurance markets with state-specific carriers. Texas residents can use TDI’s HelpInsure tool to find insurers specifically rated for Texas properties.

Local regulations also impact coverage requirements and options. In coastal areas of Texas, separate windstorm policies might be necessary since standard policies may exclude hurricane damage.

What strategies can I employ to find the most affordable homeowners insurance without sacrificing quality?

Bundling multiple policies with one insurer typically results in significant discounts. Combining home and auto insurance can save 10-15% on premiums with many carriers.

Installing security systems, smoke detectors, and water leak detection devices can qualify for discounts while improving your home’s safety. Document these improvements when requesting quotes.

Adjusting your deductible strategically balances premium costs with out-of-pocket risk. A higher deductible lowers monthly payments, but ensure you can comfortably cover that amount if you need to file a claim.